All About Investing in Gold: A Beginner's Guide

Gold has been a valuable and sought-after commodity throughout history, and it continues to be a popular investment option today. Whether you're a seasoned investor or just starting out, understanding the ins and outs of investing in gold is crucial for making informed decisions and potentially maximizing your returns.

Why Invest in Gold?

- Safe Haven Asset: Gold is often considered a safe haven asset during times of economic or political uncertainty, as its value tends to hold steady or even increase when other investments decline.

- Inflation Hedge: Gold can help protect your portfolio against rising inflation, as its value tends to follow the inflation rate over the long term.

- Diversification: Investing in gold can help diversify your portfolio, reducing your overall risk. Gold tends to have a negative correlation with stocks and bonds, meaning its performance can offset losses in other asset classes.

- Preservation of Wealth: Gold has maintained its value over centuries, making it a reliable way to preserve your wealth in the face of market fluctuations or currency debasement.

Different Options for Investing in Gold

There are several ways to invest in gold, each with its own advantages and drawbacks:

4.5 out of 5

| Language | : | English |

| File size | : | 1648 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 257 pages |

1. Physical Gold (Bullion)

Investing in physical gold involves buying gold coins, bars, or ingots. This option provides the most direct exposure to the gold market, but it also comes with storage and security costs.

2. Gold ETFs

Gold ETFs (exchange-traded funds) are baskets of gold shares that trade on stock exchanges. They offer a more convenient and cost-effective way to invest in gold without the need for physical storage. Gold ETFs are backed by physical gold holdings and can be bought and sold like stocks.

3. Gold Mining Stocks

Gold mining stocks represent companies involved in gold exploration and production. These stocks can provide exposure to the gold market and potential dividends, but they also carry additional company-specific risks.

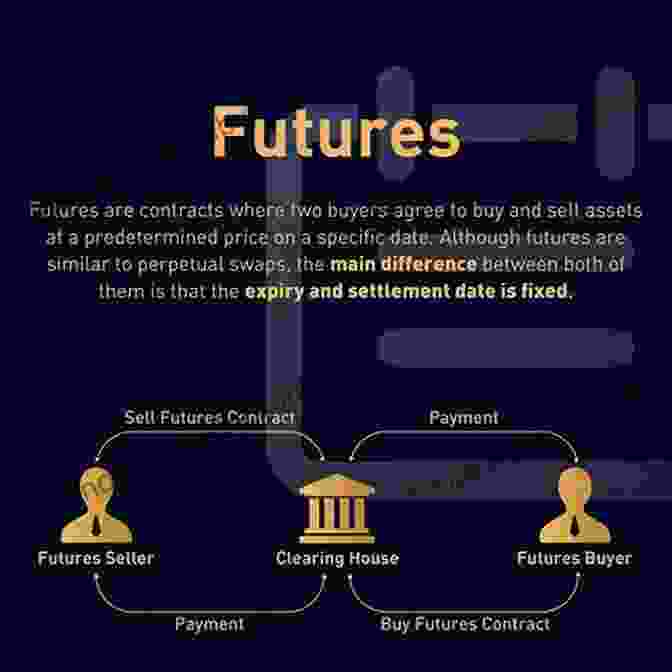

4. Gold Futures and Options

Gold futures and options are contracts to buy or sell gold at a specific price on a future date. These instruments are used by experienced investors for hedging or speculative purposes.

Risks of Investing in Gold

- Price Volatility: Gold prices can fluctuate significantly over the short term, leading to potential losses.

- Storage Costs: Physical gold requires secure storage facilities, which can be expensive.

- Counterfeit Risk: There is a risk of purchasing counterfeit gold coins or bars, especially when buying from unfamiliar sources.

- Limited Yield: Gold does not generate dividends or interest, so it relies solely on price appreciation for returns.

Strategies for Investing in Gold

- Dollar-Cost Averaging: Investing fixed amounts in gold at regular intervals can help reduce the impact of price fluctuations.

- Diversification: Allocate a portion of your portfolio to gold alongside other asset classes to minimize risks.

- Long-Term Investment: Gold performs best over the long term. Consider holding gold investments for at least five years or more.

- Research and Due Diligence: Thoroughly research different investment options and consult with financial professionals before making any decisions.

Investing in gold can be a valuable way to diversify your portfolio, hedge against inflation, and preserve your wealth. By understanding the different investment options, risks, and strategies involved, you can make informed decisions and potentially maximize your returns. Remember, gold investment should be part of a broader investment strategy and should align with your personal risk tolerance and financial goals.

4.5 out of 5

| Language | : | English |

| File size | : | 1648 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 257 pages |

Do you want to contribute by writing guest posts on this blog?

Please contact us and send us a resume of previous articles that you have written.

Book

Book Novel

Novel Page

Page Chapter

Chapter Text

Text Story

Story Genre

Genre Reader

Reader Library

Library Paperback

Paperback E-book

E-book Magazine

Magazine Newspaper

Newspaper Paragraph

Paragraph Sentence

Sentence Bookmark

Bookmark Shelf

Shelf Glossary

Glossary Bibliography

Bibliography Foreword

Foreword Preface

Preface Synopsis

Synopsis Annotation

Annotation Footnote

Footnote Manuscript

Manuscript Scroll

Scroll Codex

Codex Tome

Tome Bestseller

Bestseller Classics

Classics Library card

Library card Narrative

Narrative Biography

Biography Autobiography

Autobiography Memoir

Memoir Reference

Reference Encyclopedia

Encyclopedia Eli Simon

Eli Simon David M Killoran

David M Killoran Cassandra Clare

Cassandra Clare Carolyn Forche

Carolyn Forche Bruce Bryans

Bruce Bryans Ajax Lygan

Ajax Lygan Dawn Turner Trice

Dawn Turner Trice K C Mills

K C Mills David Mccullough

David Mccullough Paul Kalas

Paul Kalas David Feherty

David Feherty David The Good

David The Good David Rockefeller

David Rockefeller David Williams

David Williams David M Oshinsky

David M Oshinsky David B Mccoy

David B Mccoy David Herron

David Herron Lindsey Ellison

Lindsey Ellison Dave Bartell

Dave Bartell David Woods

David Woods

Light bulbAdvertise smarter! Our strategic ad space ensures maximum exposure. Reserve your spot today!

Gage HayesDreams From The Elves: A Literary Journey into the Enchanting Realm of Elven...

Gage HayesDreams From The Elves: A Literary Journey into the Enchanting Realm of Elven... Abe MitchellFollow ·19.4k

Abe MitchellFollow ·19.4k Gregory WoodsFollow ·14.4k

Gregory WoodsFollow ·14.4k Aldous HuxleyFollow ·14.7k

Aldous HuxleyFollow ·14.7k Edgar HayesFollow ·17.4k

Edgar HayesFollow ·17.4k Federico García LorcaFollow ·6.5k

Federico García LorcaFollow ·6.5k David PetersonFollow ·19k

David PetersonFollow ·19k Harold PowellFollow ·14.1k

Harold PowellFollow ·14.1k Dustin RichardsonFollow ·9.2k

Dustin RichardsonFollow ·9.2k

Jayden Cox

Jayden CoxFaith Lies and the War on Terror: Exposing the Truth...

In the aftermath of the 9/11...

Jack Powell

Jack PowellMad About the Trump Era: Mad Magazine 2024

The Trump...

Warren Bell

Warren BellYou Got This: Tips for Women Who Want to Rock at Real...

Real estate...

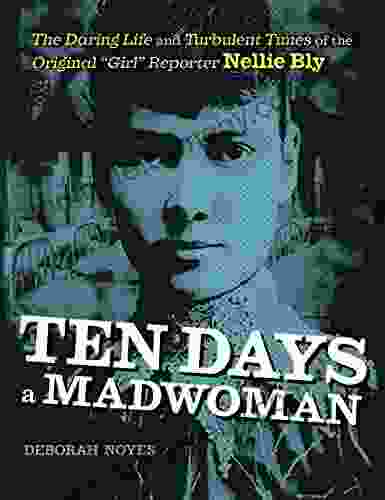

Ernest Cline

Ernest ClineThe Daring Life and Turbulent Times of the Original Girl...

: Embracing the Spirit of Adventure In...

4.5 out of 5

| Language | : | English |

| File size | : | 1648 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 257 pages |