Empowering Shareholder Value Creation: A Comprehensive Guide

In today's dynamic and competitive business landscape, creating long-term shareholder value is paramount for sustained success and investor confidence. This comprehensive article delves into the principles, strategies, and processes outlined in the groundbreaking book, "Principles, Strategies, and Processes for Creating Long-Term Shareholder Value," providing insights and actionable recommendations for businesses seeking to enhance their value proposition.

4.7 out of 5

| Language | : | English |

| File size | : | 12273 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 570 pages |

Understanding Shareholder Value

Shareholder value, simply put, is the total value of a company to its shareholders, represented by the market capitalization of its outstanding shares. Creating long-term shareholder value involves enhancing the company's financial performance, operational efficiency, and overall competitiveness, resulting in increased share price and investor returns.

Principles of Shareholder Value Creation

The book emphasizes three fundamental principles for creating long-term shareholder value:

- Focus on cash flow: Generating strong and consistent cash flow is the lifeblood of any business. Companies should prioritize activities that increase cash flow and reduce cash outflows.

- Maximize return on invested capital: Return on invested capital (ROIC) measures the efficiency with which a company uses its capital. Businesses should strive to maximize ROIC by investing in projects that generate higher returns than the cost of capital.

- Manage risk and uncertainty: Shareholders value predictability and stability. Companies should implement risk management strategies to mitigate potential threats and uncertainties that could impact their long-term performance.

Strategies for Enhancing Value

The book outlines several actionable strategies for enhancing shareholder value:

- Organic growth: Investing in innovation, research and development, and marketing initiatives to drive organic sales and market share growth.

- Acquisitions and mergers: Acquiring or merging with complementary businesses to expand operations, gain market share, or enhance capabilities.

- Operational efficiency: Implementing lean processes, automating tasks, and optimizing supply chains to reduce costs and improve efficiency.

- Capital allocation: Prudently allocating capital to investments with high ROIC, such as new projects, acquisitions, or share buybacks.

- Corporate governance: Establishing sound corporate governance practices, including independent boards, transparency, and accountability, to instill investor confidence.

Processes for Sustainable Value Creation

To create sustainable long-term shareholder value, companies must implement robust processes:

- Strategic planning: Developing a comprehensive strategic plan that aligns with the principles of shareholder value creation and sets clear performance targets.

- Performance measurement: Establishing key performance indicators (KPIs) and regularly monitoring progress to ensure alignment with strategic objectives.

- Continuous improvement: Embracing a culture of continuous improvement, identifying areas for optimization and implementing corrective actions.

- Stakeholder engagement: Maintaining open communication and fostering relationships with investors, analysts, and other stakeholders to gain insights and build trust.

- Scenario planning: Developing contingency plans and stress-testing strategies to mitigate potential risks and prepare for unforeseen events.

Benefits of Creating Shareholder Value

Creating long-term shareholder value brings numerous benefits to companies:

- Increased share price and investor returns: Shareholders benefit from increased share value, dividends, and overall financial performance.

- Access to capital: Companies with strong shareholder value can more easily raise capital for growth and expansion.

- Competitive advantage: Companies that create long-term shareholder value are often perceived as more stable and reliable, gaining a competitive edge.

- Reduced volatility: A strong shareholder value proposition can mitigate market volatility and protect against downturns.

- Enhanced reputation: Companies with a track record of creating shareholder value are often viewed favorably by consumers, employees, and the wider community.

Creating long-term shareholder value is an ongoing journey that requires a deep understanding of the principles, strategies, and processes involved. By embracing the principles of cash flow, ROIC, and risk management, implementing value-enhancing strategies, and establishing robust processes for sustainable growth, companies can unlock their full potential and deliver exceptional returns for their shareholders. The book, "Principles, Strategies, and Processes for Creating Long-Term Shareholder Value," serves as an invaluable guide for organizations seeking to embark on this transformative path.

Emboldened with the knowledge and insights gained from this comprehensive guide, business leaders can drive innovation, optimize performance, and build thriving enterprises that generate lasting value for all stakeholders.

4.7 out of 5

| Language | : | English |

| File size | : | 12273 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 570 pages |

Do you want to contribute by writing guest posts on this blog?

Please contact us and send us a resume of previous articles that you have written.

Book

Book Novel

Novel Page

Page Chapter

Chapter Text

Text Story

Story Genre

Genre Reader

Reader Library

Library Paperback

Paperback E-book

E-book Magazine

Magazine Newspaper

Newspaper Paragraph

Paragraph Sentence

Sentence Bookmark

Bookmark Shelf

Shelf Glossary

Glossary Bibliography

Bibliography Foreword

Foreword Preface

Preface Synopsis

Synopsis Annotation

Annotation Footnote

Footnote Manuscript

Manuscript Scroll

Scroll Codex

Codex Tome

Tome Bestseller

Bestseller Classics

Classics Library card

Library card Narrative

Narrative Biography

Biography Autobiography

Autobiography Memoir

Memoir Reference

Reference Encyclopedia

Encyclopedia David Lewis

David Lewis Deb Perelman

Deb Perelman Geraldine Woods

Geraldine Woods David G Cook

David G Cook Dan Rattiner

Dan Rattiner David M Buerge

David M Buerge Dave Foster

Dave Foster Ryan Estrada

Ryan Estrada David Berlinski

David Berlinski Vicki Myron

Vicki Myron Brigid Coady

Brigid Coady David Andrew Snider

David Andrew Snider Dave Collins

Dave Collins Beatriz Williams

Beatriz Williams David Western

David Western Marina Ermakova

Marina Ermakova David Fine

David Fine David Schoem

David Schoem Debby Applegate

Debby Applegate David Jefferson

David Jefferson

Light bulbAdvertise smarter! Our strategic ad space ensures maximum exposure. Reserve your spot today!

Franklin BellBreak the Mold and Elevate Your Career: A Comprehensive Guide to "How to Get...

Franklin BellBreak the Mold and Elevate Your Career: A Comprehensive Guide to "How to Get...

Jedidiah HayesMy Seven Years As Hitting Coach For The Williams Sisters: A Journey Through...

Jedidiah HayesMy Seven Years As Hitting Coach For The Williams Sisters: A Journey Through...

Shannon SimmonsPersuasive Presentations: The Ultimate Guide to Business Presentations That...

Shannon SimmonsPersuasive Presentations: The Ultimate Guide to Business Presentations That... Chinua AchebeFollow ·6.2k

Chinua AchebeFollow ·6.2k Scott ParkerFollow ·10.1k

Scott ParkerFollow ·10.1k Felix CarterFollow ·14.7k

Felix CarterFollow ·14.7k Henry GreenFollow ·12.5k

Henry GreenFollow ·12.5k Ezekiel CoxFollow ·3.2k

Ezekiel CoxFollow ·3.2k Harold PowellFollow ·14.1k

Harold PowellFollow ·14.1k Aron CoxFollow ·7.9k

Aron CoxFollow ·7.9k Duane KellyFollow ·6.6k

Duane KellyFollow ·6.6k

Jayden Cox

Jayden CoxFaith Lies and the War on Terror: Exposing the Truth...

In the aftermath of the 9/11...

Jack Powell

Jack PowellMad About the Trump Era: Mad Magazine 2024

The Trump...

Warren Bell

Warren BellYou Got This: Tips for Women Who Want to Rock at Real...

Real estate...

Ernest Cline

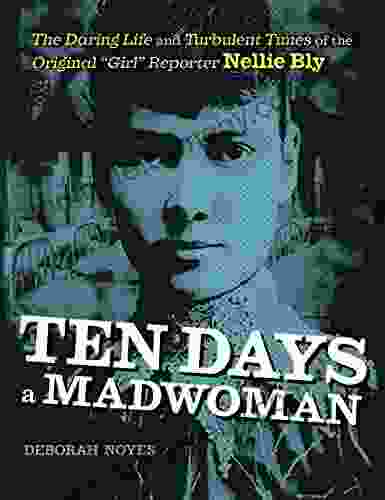

Ernest ClineThe Daring Life and Turbulent Times of the Original Girl...

: Embracing the Spirit of Adventure In...

4.7 out of 5

| Language | : | English |

| File size | : | 12273 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 570 pages |