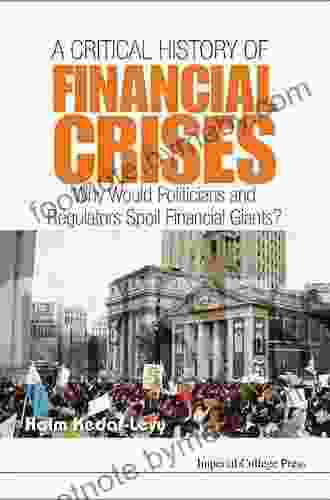

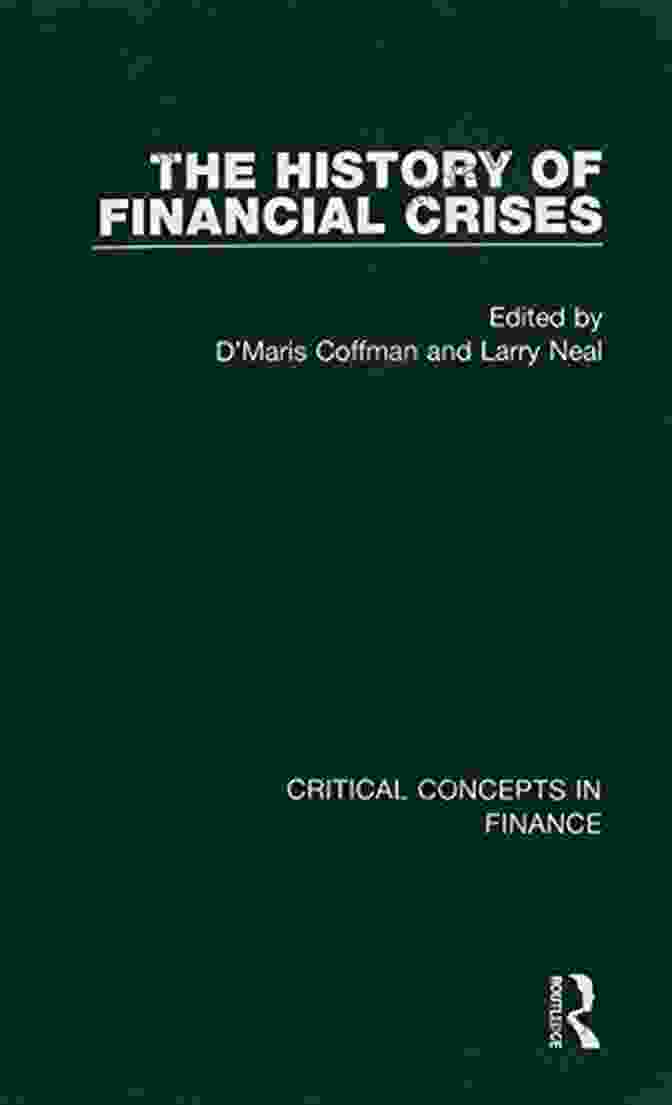

Unveiling the Hidden Truths: A Critical History of Financial Crises

Delve into the Captivating Narrative of Financial Market Meltdowns

In the realm of finance, amidst the labyrinthine world of investments and market fluctuations, lies a complex tale of financial crises. These seismic events, like thunderbolts crashing upon the unsuspecting landscape, have left an enduring mark on societies and economies alike. To unravel the intricate tapestry of financial crises, a comprehensive historical exploration is essential.

5 out of 5

| Language | : | English |

| File size | : | 6622 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 226 pages |

Introducing the groundbreaking work, "Critical History of Financial Crises," a literary masterpiece that illuminates the multifaceted nature of these devastating episodes. With meticulous research and captivating prose, this seminal volume delves into the depths of financial market meltdowns, exposing their underlying causes, far-reaching consequences, and the lessons that can be gleaned from these tumultuous times.

Unveiling the Anatomy of Financial Crises

"Critical History of Financial Crises" meticulously dissects the anatomy of financial crises, unveiling the intricate interplay of factors that culminate in these catastrophic events. The book unveils the role of:

- Excessive Risk-Taking: The insatiable pursuit of profits often leads financial institutions to engage in reckless risk-taking, pushing the limits of sound judgment.

- Regulatory Failures: Lax oversight and inadequate regulations allow financial markets to operate with unchecked exuberance, paving the way for crises.

- Systemic Fragility: The interconnectedness of financial institutions creates a domino effect, amplifying the impact of crisis events.

li>Psychological Factors: Fear, greed, and herd mentality can drive investors to make irrational decisions, exacerbating market instability.

Identifying Historical Patterns and Comparative Analysis

Through a comparative analysis of historical financial crises, this groundbreaking work unveils recurring patterns and identifies commonalities across these devastating events. The book meticulously examines:

- The Great Depression: A seminal crisis that devastated economies worldwide, leaving a legacy of unemployment and social unrest.

- The Asian Financial Crisis: A contagion that swept through East Asian economies, exposing the vulnerabilities of emerging markets.

- The Global Financial Crisis of 2008: A systemic meltdown that shook the foundations of the global financial system.

By comparing these pivotal crises, "Critical History of Financial Crises" provides a comprehensive understanding of the factors that contribute to their emergence and the challenges they pose to policymakers.

Extracting Valuable Lessons for the Future

Beyond its historical analysis, this invaluable book offers profound lessons for the future, equipping readers with the knowledge to navigate the treacherous waters of financial markets. The author emphasizes:

- The Importance of Regulation: Effective regulation is crucial to prevent excessive risk-taking and ensure financial market stability.

- The Need for Systemic Oversight: Regulators must focus not only on individual institutions but also on the interconnectedness of the financial system.

- The Value of Behavioral Finance: Understanding the psychological factors that influence investor behavior can help mitigate risks.

- The Role of Central Banks: Central banks play a vital role in managing liquidity, preventing crises, and mitigating their impact.

A Must-Read for Finance Professionals and Policymakers

"Critical History of Financial Crises" is an indispensable resource for finance professionals, policymakers, academics, and anyone seeking a deeper understanding of the complex world of financial markets. Its comprehensive analysis, astute insights, and practical lessons empower readers to navigate the challenges and opportunities presented by the ever-evolving financial landscape.

Free Download your copy today and embark on an illuminating journey into the realm of financial crises. Unlock the secrets, learn the lessons, and prepare yourself for the challenges that lie ahead. "Critical History of Financial Crises" is the ultimate guide to understanding the complexities of financial markets and mitigating the risks they pose.

Embark on an Intellectual Odyssey

With "Critical History of Financial Crises," you will embark on an intellectual odyssey that will forever alter your perspective on financial markets. Immerse yourself in the captivating narrative, unravel the mysteries of financial crises, and emerge as a more informed and astute financial professional.

Free Download your copy now and join the ranks of those who possess the knowledge and wisdom to navigate the complexities of the financial world.

5 out of 5

| Language | : | English |

| File size | : | 6622 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 226 pages |

Do you want to contribute by writing guest posts on this blog?

Please contact us and send us a resume of previous articles that you have written.

Book

Book Novel

Novel Page

Page Chapter

Chapter Text

Text Story

Story Genre

Genre Reader

Reader Library

Library Paperback

Paperback E-book

E-book Magazine

Magazine Newspaper

Newspaper Paragraph

Paragraph Sentence

Sentence Bookmark

Bookmark Shelf

Shelf Glossary

Glossary Bibliography

Bibliography Foreword

Foreword Preface

Preface Synopsis

Synopsis Annotation

Annotation Footnote

Footnote Manuscript

Manuscript Scroll

Scroll Codex

Codex Tome

Tome Bestseller

Bestseller Classics

Classics Library card

Library card Narrative

Narrative Biography

Biography Autobiography

Autobiography Memoir

Memoir Reference

Reference Encyclopedia

Encyclopedia David Picciuto

David Picciuto David Hutchison

David Hutchison David Putnam

David Putnam David Holt

David Holt Daniel Tammet

Daniel Tammet David Enterprises

David Enterprises James Rollins

James Rollins David Groves

David Groves David Archer

David Archer Darryl Hughes

Darryl Hughes Deborah Bull

Deborah Bull David Thomson

David Thomson Stephen L Sass

Stephen L Sass Deanna Kahler

Deanna Kahler Hunter S Thompson

Hunter S Thompson David J Rothman

David J Rothman R Neil Hewison

R Neil Hewison Douglas Johnson

Douglas Johnson David Weaver

David Weaver Dave Whitlock

Dave Whitlock

Light bulbAdvertise smarter! Our strategic ad space ensures maximum exposure. Reserve your spot today!

Alvin BellThe Squared Circle: A Gripping Exploration of Life, Death, and the Enigma of...

Alvin BellThe Squared Circle: A Gripping Exploration of Life, Death, and the Enigma of...

Glenn HayesBones and the Clown Mix-Up Mystery: An Adventure That Will Keep Your Child on...

Glenn HayesBones and the Clown Mix-Up Mystery: An Adventure That Will Keep Your Child on... Ruben CoxFollow ·3.9k

Ruben CoxFollow ·3.9k Andres CarterFollow ·12.7k

Andres CarterFollow ·12.7k Neal WardFollow ·11.7k

Neal WardFollow ·11.7k Trevor BellFollow ·12.5k

Trevor BellFollow ·12.5k William WordsworthFollow ·10.8k

William WordsworthFollow ·10.8k Juan RulfoFollow ·8.2k

Juan RulfoFollow ·8.2k Chandler WardFollow ·3.8k

Chandler WardFollow ·3.8k Colin FosterFollow ·16.7k

Colin FosterFollow ·16.7k

Jayden Cox

Jayden CoxFaith Lies and the War on Terror: Exposing the Truth...

In the aftermath of the 9/11...

Jack Powell

Jack PowellMad About the Trump Era: Mad Magazine 2024

The Trump...

Warren Bell

Warren BellYou Got This: Tips for Women Who Want to Rock at Real...

Real estate...

Ernest Cline

Ernest ClineThe Daring Life and Turbulent Times of the Original Girl...

: Embracing the Spirit of Adventure In...

5 out of 5

| Language | : | English |

| File size | : | 6622 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 226 pages |