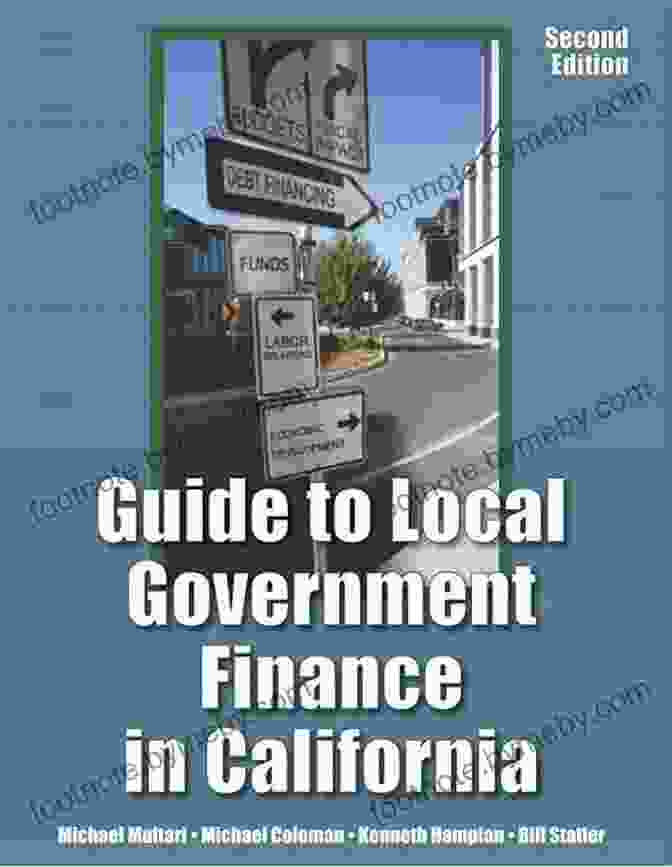

Unveiling the Intricacies of Local Government Finance in California: A Comprehensive Guide

Local governments play a pivotal role in shaping the lives of Californians, providing essential services that underpin our communities' well-being. From infrastructure maintenance to public safety and education, these services rely heavily on financial resources. Understanding how local governments finance their operations is crucial for both residents and policymakers alike. To address this need, this comprehensive guide delves into the complexities of local government finance in the Golden State.

Revenue Streams for California's Local Governments

Local governments in California generate revenue from various sources, each with its unique characteristics and implications:

4.3 out of 5

| Language | : | English |

| File size | : | 22668 KB |

| Screen Reader | : | Supported |

| Print length | : | 332 pages |

Property Taxes

Property taxes constitute the cornerstone of local government revenue, accounting for approximately half of all revenue collected. Property taxes are levied on real estate, including land and buildings, based on their assessed value. Homeowners and businesses bear the brunt of property tax payments.

Sales Taxes

Sales taxes are levied on the Free Download of goods and services within a local government's jurisdiction. The state sets the base sales tax rate, but local governments can impose additional taxes, resulting in varying rates across the state. Sales taxes are a significant revenue source for municipalities, especially in areas with robust retail sectors.

Use Taxes

Use taxes are similar to sales taxes but apply to the storage, use, or consumption of tangible personal property Free Downloadd outside the state but brought into the local jurisdiction. Use taxes ensure that businesses outside the local government's boundaries do not gain an unfair advantage over local businesses.

Other Revenue Sources

Beyond these primary sources, local governments also collect revenue from a myriad of other sources, such as:

- Hotel occupancy taxes

- Business license fees

- Permit fees

- Fines and penalties

- Investment income

- Grants

Spending Priorities of California's Local Governments

The revenue generated by local governments is allocated towards various spending priorities that align with the needs of their communities. Key expenditure categories include:

Public Safety

Ensuring the well-being of residents is paramount, and local governments dedicate substantial resources to public safety, including funding police, fire departments, and emergency services.

Education

Local governments play a vital role in providing accessible and quality education for their communities. Funds are allocated to public schools, libraries, and community colleges.

Infrastructure

Maintaining and improving infrastructure, such as roads, bridges, water systems, and parks, is essential for the smooth functioning of communities. Local governments prioritize infrastructure projects based on their specific needs and resources.

Social Services

Local governments provide a range of social services to support the well-being of their residents, including healthcare, housing assistance, and programs for seniors and youth.

Administration

Adequate funding is necessary to support the administrative functions of local governments, including staffing, technology, and legal services.

Challenges in Local Government Finance

Despite the diverse revenue streams, local governments in California face several challenges that can hinder their financial stability:

Economic Downturns

Economic downturns can lead to a decline in revenue from sales and property taxes, straining local government budgets.

Unfunded Mandates

State and federal governments often impose mandates on local governments without providing adequate funding, creating financial burdens.

Infrastructure Needs

Aging infrastructure requires ongoing maintenance and upgrades, which can outpace the financial capacity of local governments.

Revenue Limitations

Strict limitations on raising taxes, such as Proposition 13, can constrain local governments' ability to generate sufficient revenue.

Innovative Financial Strategies

To address these challenges, local governments in California are exploring innovative financial strategies, such as:

Public-Private Partnerships

Collaborating with private sector partners can provide local governments with additional funding sources and expertise for infrastructure projects.

Impact Fees

Charging new developments impact fees to mitigate the additional burden they place on infrastructure can generate revenue for capital projects.

Performance-Based Budgeting

Aligning budgeting processes with performance outcomes can improve efficiency and ensure that funds are allocated effectively.

Reserve Funds

Establishing reserve funds can provide a financial cushion during economic downturns or emergencies.

Local government finance in California is a complex and dynamic field that underpins the essential services we rely on daily. Understanding the revenue streams, spending priorities, challenges, and innovative strategies employed by local governments is crucial for informed decision-making and fostering sustainable communities. This comprehensive guide provides an in-depth exploration of local government finance in the Golden State, empowering readers to engage in informed discussions and advocate for sound financial practices.

4.3 out of 5

| Language | : | English |

| File size | : | 22668 KB |

| Screen Reader | : | Supported |

| Print length | : | 332 pages |

Do you want to contribute by writing guest posts on this blog?

Please contact us and send us a resume of previous articles that you have written.

Book

Book Novel

Novel Page

Page Chapter

Chapter Text

Text Story

Story Genre

Genre Reader

Reader Library

Library Paperback

Paperback E-book

E-book Magazine

Magazine Newspaper

Newspaper Paragraph

Paragraph Sentence

Sentence Bookmark

Bookmark Shelf

Shelf Glossary

Glossary Bibliography

Bibliography Foreword

Foreword Preface

Preface Synopsis

Synopsis Annotation

Annotation Footnote

Footnote Manuscript

Manuscript Scroll

Scroll Codex

Codex Tome

Tome Bestseller

Bestseller Classics

Classics Library card

Library card Narrative

Narrative Biography

Biography Autobiography

Autobiography Memoir

Memoir Reference

Reference Encyclopedia

Encyclopedia Dave Hughes

Dave Hughes David Bischoff

David Bischoff Debbie Tremel

Debbie Tremel David A Adler

David A Adler David Mack

David Mack Dean Stoecker

Dean Stoecker Dan Michaels

Dan Michaels David Callahan

David Callahan David Folkenflik

David Folkenflik David A Wilson

David A Wilson David Kadavy

David Kadavy Gordon Macquarrie

Gordon Macquarrie David Forbes

David Forbes David Rohde

David Rohde Colin Cowie

Colin Cowie David Barnett

David Barnett David Mcgriffy

David Mcgriffy John Robert Allman

John Robert Allman Deborah Kops

Deborah Kops David I Kertzer

David I Kertzer

Light bulbAdvertise smarter! Our strategic ad space ensures maximum exposure. Reserve your spot today!

Griffin MitchellMaster the GRE Verbal Section with 500 Essential Questions: Unlocking Success...

Griffin MitchellMaster the GRE Verbal Section with 500 Essential Questions: Unlocking Success... Glen PowellFollow ·8.1k

Glen PowellFollow ·8.1k Arthur Conan DoyleFollow ·13.9k

Arthur Conan DoyleFollow ·13.9k Brenton CoxFollow ·11.9k

Brenton CoxFollow ·11.9k Michael ChabonFollow ·19.1k

Michael ChabonFollow ·19.1k Roberto BolañoFollow ·11.7k

Roberto BolañoFollow ·11.7k Andres CarterFollow ·12.7k

Andres CarterFollow ·12.7k John GreenFollow ·15.7k

John GreenFollow ·15.7k Ernest J. GainesFollow ·8.5k

Ernest J. GainesFollow ·8.5k

Jayden Cox

Jayden CoxFaith Lies and the War on Terror: Exposing the Truth...

In the aftermath of the 9/11...

Jack Powell

Jack PowellMad About the Trump Era: Mad Magazine 2024

The Trump...

Warren Bell

Warren BellYou Got This: Tips for Women Who Want to Rock at Real...

Real estate...

Ernest Cline

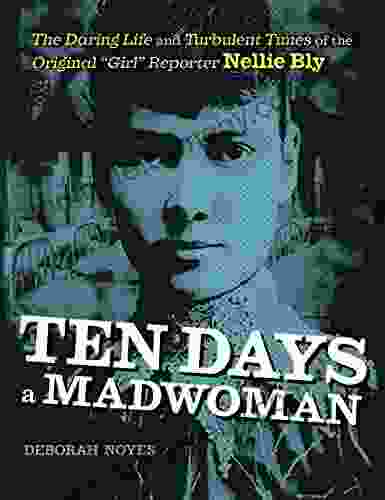

Ernest ClineThe Daring Life and Turbulent Times of the Original Girl...

: Embracing the Spirit of Adventure In...

4.3 out of 5

| Language | : | English |

| File size | : | 22668 KB |

| Screen Reader | : | Supported |

| Print length | : | 332 pages |