Unveiling the Great Multinational Tax Rort: A Comprehensive Exploration

In the labyrinthine world of international finance, a hidden realm exists where multinational corporations wield their vast power to circumvent taxes, leaving countries and citizens shortchanged. This article unravels the intricate web of the Great Multinational Tax Rort, exposing the schemes, loopholes, and offshore havens that enable corporations to avoid paying their fair share.

5 out of 5

| Language | : | English |

| File size | : | 637 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 256 pages |

The Elusive Nature of Global Tax Justice

The concept of tax justice hinges on the principle that corporations should contribute their fair share to the societies from which they derive their profits. However, a global tax regime riddled with loopholes and disparities has created an uneven playing field, allowing multinationals to exploit loopholes and shift profits offshore to avoid paying their dues.

The Anatomy of Tax Avoidance

Multinational corporations employ a myriad of strategies to reduce their tax liabilities, including:

- Transfer Pricing: Charging artificial prices for goods and services within their own subsidiaries to shift profits to lower-tax jurisdictions.

- Double Irish with a Dutch Sandwich: A complex scheme involving Irish and Dutch subsidiaries to avoid taxes in both countries.

- Tax Havens: Establishing subsidiaries in countries with notoriously low tax rates and lax regulations, known as tax havens.

li>Base Erosion and Profit Shifting: Shifting profits to low-tax jurisdictions through complex financial arrangements.

The Impact on Countries and Citizens

The implications of the Great Multinational Tax Rort are far-reaching and detrimental to countries and citizens worldwide:

- Reduced Government Revenue: Lost tax revenue undermines public services, such as healthcare, education, and infrastructure, depriving citizens of essential benefits.

- Unfair Competition: Tax-avoiding multinationals gain an unfair advantage over small businesses and local companies that pay their taxes honestly.

- Erosion of Democracy: When corporations prioritize tax avoidance over social responsibility, it undermines public trust and weakens democratic institutions.

The Call for Global Tax Reform

Addressing the Great Multinational Tax Rort requires a concerted global effort:

- Closing Loopholes: Eliminating loopholes that allow multinationals to shift profits offshore and engage in tax avoidance.

- Country-by-Country Reporting: Mandating multinationals to publicly report their financial data on a country-by-country basis, increasing transparency and accountability.

- Minimum Corporate Tax Rate: Establishing a global minimum corporate tax rate to prevent multinationals from shopping for the lowest tax rates.

The Great Multinational Tax Rort is a global scourge that undermines tax justice, deprives countries of vital revenue, and distorts competition. By exposing the intricate schemes used by corporations to avoid paying their fair share, this article serves as a clarion call for global tax reform. It is time for governments, citizens, and ethical businesses to unite in demanding a more just and equitable tax system that benefits all.

5 out of 5

| Language | : | English |

| File size | : | 637 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 256 pages |

Do you want to contribute by writing guest posts on this blog?

Please contact us and send us a resume of previous articles that you have written.

Book

Book Novel

Novel Page

Page Chapter

Chapter Text

Text Story

Story Genre

Genre Reader

Reader Library

Library Paperback

Paperback E-book

E-book Magazine

Magazine Newspaper

Newspaper Paragraph

Paragraph Sentence

Sentence Bookmark

Bookmark Shelf

Shelf Glossary

Glossary Bibliography

Bibliography Foreword

Foreword Preface

Preface Synopsis

Synopsis Annotation

Annotation Footnote

Footnote Manuscript

Manuscript Scroll

Scroll Codex

Codex Tome

Tome Bestseller

Bestseller Classics

Classics Library card

Library card Narrative

Narrative Biography

Biography Autobiography

Autobiography Memoir

Memoir Reference

Reference Encyclopedia

Encyclopedia David Thomson

David Thomson David Sammel

David Sammel David Hart

David Hart Gregory T Cushman

Gregory T Cushman Dave Hirschman

Dave Hirschman Seth Burkett

Seth Burkett David H Stern

David H Stern Dave Bosanko

Dave Bosanko Susan E Massenzio

Susan E Massenzio David Mcintosh

David Mcintosh David Berry

David Berry David Radman

David Radman Suzy Hopkins

Suzy Hopkins S R Taddei

S R Taddei David G Taylor

David G Taylor Daniel Williamson

Daniel Williamson Cathy Glass

Cathy Glass M Prefontaine

M Prefontaine Dartanya A Williams Sr

Dartanya A Williams Sr David Bain

David Bain

Light bulbAdvertise smarter! Our strategic ad space ensures maximum exposure. Reserve your spot today!

Allen ParkerThurgood Marshall: The Making of America — A Journey of Courage, Justice, and...

Allen ParkerThurgood Marshall: The Making of America — A Journey of Courage, Justice, and...

Eugene PowellFatemarked: The Fatemarked Epic: A Literary Masterpiece that Transforms Your...

Eugene PowellFatemarked: The Fatemarked Epic: A Literary Masterpiece that Transforms Your...

Alex FosterHow to Build a Million-Dollar Digital Marketing Agency: The Complete Guide to...

Alex FosterHow to Build a Million-Dollar Digital Marketing Agency: The Complete Guide to... Keith CoxFollow ·5k

Keith CoxFollow ·5k Jake CarterFollow ·6k

Jake CarterFollow ·6k Forrest BlairFollow ·8.3k

Forrest BlairFollow ·8.3k Tim ReedFollow ·13.7k

Tim ReedFollow ·13.7k Eli BlairFollow ·8.8k

Eli BlairFollow ·8.8k Frank MitchellFollow ·18.2k

Frank MitchellFollow ·18.2k Ralph Waldo EmersonFollow ·3.8k

Ralph Waldo EmersonFollow ·3.8k Demetrius CarterFollow ·19.7k

Demetrius CarterFollow ·19.7k

Jayden Cox

Jayden CoxFaith Lies and the War on Terror: Exposing the Truth...

In the aftermath of the 9/11...

Jack Powell

Jack PowellMad About the Trump Era: Mad Magazine 2024

The Trump...

Warren Bell

Warren BellYou Got This: Tips for Women Who Want to Rock at Real...

Real estate...

Ernest Cline

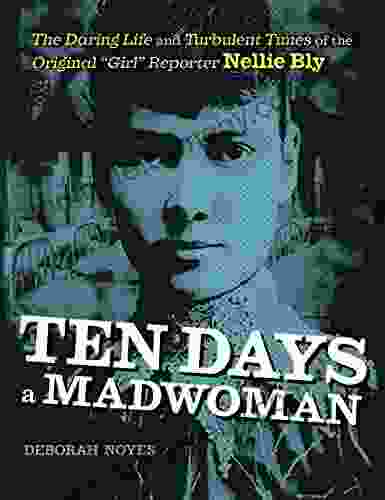

Ernest ClineThe Daring Life and Turbulent Times of the Original Girl...

: Embracing the Spirit of Adventure In...

5 out of 5

| Language | : | English |

| File size | : | 637 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 256 pages |